Eating Healthy on a Budget: Affordable Meal Ideas

Maintaining a healthy diet is essential for overall health and wellness....

With the explosion of new retail investors platforms, it is now easier than ever for millennials to purchase gold, be it physical or digital.

The younger generations have been exposed to new technology from an earlier age, allowing them to adapt and adopt newer technologies that make investing in gold and securing their futures as easy as a few clicks.

The Royal Mint confirmed in their latest report that the number of millennials investing in gold had increased a significant 430% and added a total 25,000 new investors to their platform!

The Covid-19 pandemic was a major factor in causing the recent global financial crisis, however, gold prices increased sharply and trading in gold futures surged at the Multi Commodity Exchange of India Limited (MCX).

Take a look at Royal Gold’s latest July 2021 market roundup.

Many market experts have recommended gold as the best diversification option for investment portfolios.

The FCA (Financial Conduct Authority) found that retail investors, those who typically do not seek out financial advice are more willing to become involved with investing, especially millennials who have the advantage of the time to grow their investments.

There are many factors that need to be considered when investing in gold and this decision is highly dependent on your situation.

It is advised to seek the advice of a trained professional such as a financial adviser, however, here are some of the factors to consider:

Inflation is a general rise in the price level of an economy over a given period, typically measured by the consumer price index (CPI).

As gold is seen as a store of value to many investors, they will look to move into assets that protect them, one of these is gold.

Currently, UK inflation has seen a big jump to 2.4% alongside many countries such as the US and Germany, as economies begin to open up post coronavirus.

There are also expectations that we will see inflation continue to increase, could now be a good time to invest in gold?

Unlike currencies, gold is not directly impacted by interest rate decisions and cannot be printed to control its supply and demand.

Gold has maintained its value over time and has proven to be a reliable asset during adverse economic events which we became aware of during 2020.

Due to this, many investors treat gold as a safe haven.

Central banks often set monetary policies which affect the prices of gold. If they decide to increase the money supply in their country, they will often “print” money, devaluing their own currency in order to do so.

When this occurs, gold typically increases in value relative to the fiat currency.

Currently investment gold is VAT free, including all gold bullion bars and coin purchases in the UK and EU. Assuring your purchased gold qualifies as investment grade, no VAT will be charged.

However, there are certain criteria to be met. Your invested gold must be in the form of a coin or a bar. If you opt for a gold bar, the purity needs to be at least 995 thousandths.

For coins, the purity target is lowered to 900 thousandths. This means that any coin of 22 carats or higher will qualify for an exemption.

In reference to Digital Gold, platforms such as Royal Mint charge a 0.5% + VAT management fee per annum based on the average daily market value of your total gold investment that is stored in the vault.

For further information visit here.

Recently, with the boom of blockchain technology and cryptocurrencies, the question of “is Bitcoin the new gold” has gained significant traction, especially amongst the younger generations.

Annual Percentage Increase

Bitcoin is seen as a “Digital” version of gold thanks to its unique properties, such as its limited supply so central banks cannot print more of it compared to fiat currencies.

Bitcoin is also decentralised so it eliminates the risk of any one entity being able to control it.

Many people expect that this trend will continue to the point where the total value of Bitcoin will be greater than the total value of gold.

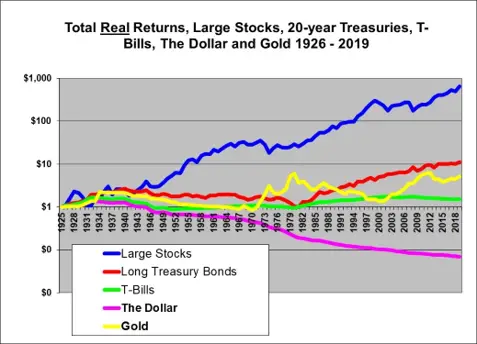

Stocks have typically performed better than gold since 1926.

Unlike gold, companies that make up the stock market are productive assets; they produce value, whereas gold stores value.

However, gold has outperformed t-bills and holding cash (i.e. money in a bank account not being invested), as cash loses its purchasing power due to inflation.

With millennials and younger populations, ESG (Environmental, Social, and Governance) factors play a large part in their investment decision-making process, this is seen more than in previous generations.

Prior to the explosion of ESG investing, investors were less concerned with the environment or impact companies were having on communities.

This has now changed, with some investors avoiding such investments, which could ultimately impact gold prices, as well as companies involved with the mining and production of gold.

Responsible investing is important as it can help to contribute towards a more sustainable future.

The investment landscape is changing fast, and digital assets are becoming more popular but let’s take a step back and look at physical gold.

Physical gold investments are products that allow you to own real physical gold in the form of gold coins, bars, nuggets or jewellery.

The value of these products is based on the value of the precious metal they contain. There are four main types of coins, including bullion, proof, numismatic, and semi-numismatic; all differ in value from an investment perspective.

Many platforms are allowing you to purchase physical gold. It is important to buy gold from a trusted and reliable trader.

When purchasing sovereign mints, such as those produced by the Royal Mint, or the Perth Mint in Australia, you are guaranteed to receive exactly what you buy.

Sovereign mints have a reputation for producing only the highest quality gold and are government regulated.

However, in this digital age, there are alternate options to invest in gold.

Digital gold is just like the physical gold you can purchase; without the responsibility for maintaining the security and storage of your asset.

Digital gold is paid for online and safely stored in insured vaults for investors.

It’s also possible to invest in gold through derivatives; sold by many brokerages. Derivatives are an asset that derives their price from another asset; in this case gold.

For example, eToro, a platform used by many millennial retail investors, allows you to purchase a contract that derives its value from the price of gold.

The advantage of purchasing derivatives is that you own it electronically; there is no need to hold the gold physically.

You can also buy gold digitally through Gold Exchange Traded Funds (ETF), and Sovereign gold bonds.

Millennials are also taking a different approach to investing in gold, and are investing in mining companies. Some prefer this method of gaining exposure to gold as mining companies often produce cash flows, dividends, and tax advantages on gains back to young investors.

As gold increases in popularity, people who hold gold want more effective ways to use it as legal tender in their everyday lives. So, how can you use gold to buy your groceries?

Many products and services have cropped up, such as gold-backed debit cards, which are debit cards that are usable if you hold gold.

In many ways working similarly to standard debit cards, when a purchase is made, the value of gold in your account is transferred over to the card provider.

Examples of this gold-backed debit card include Glint and Tally.

Along with potential benefits, as with any investment there are risks to consider.

Rather than viewing gold as a show of wealth, millennials are seeing it as a store of value to protect their future long term and to avoid the damage caused by inflation to their net worth.

Could gold be part of your portfolio?

As John Reade, chief market strategist and head of research at the World Gold Council, told Kitco News:

“Millennials are going to be working and investing for a long time, so you need to think about more than just the short term.”