Renting vs Buying: Pros and Cons and How...

In today’s society, deciding whether to rent or buy a property...

A cost of living increase was predicted to hit the UK after the pandemic ended, but people weren’t ready for the true impact of how world events would impact it.

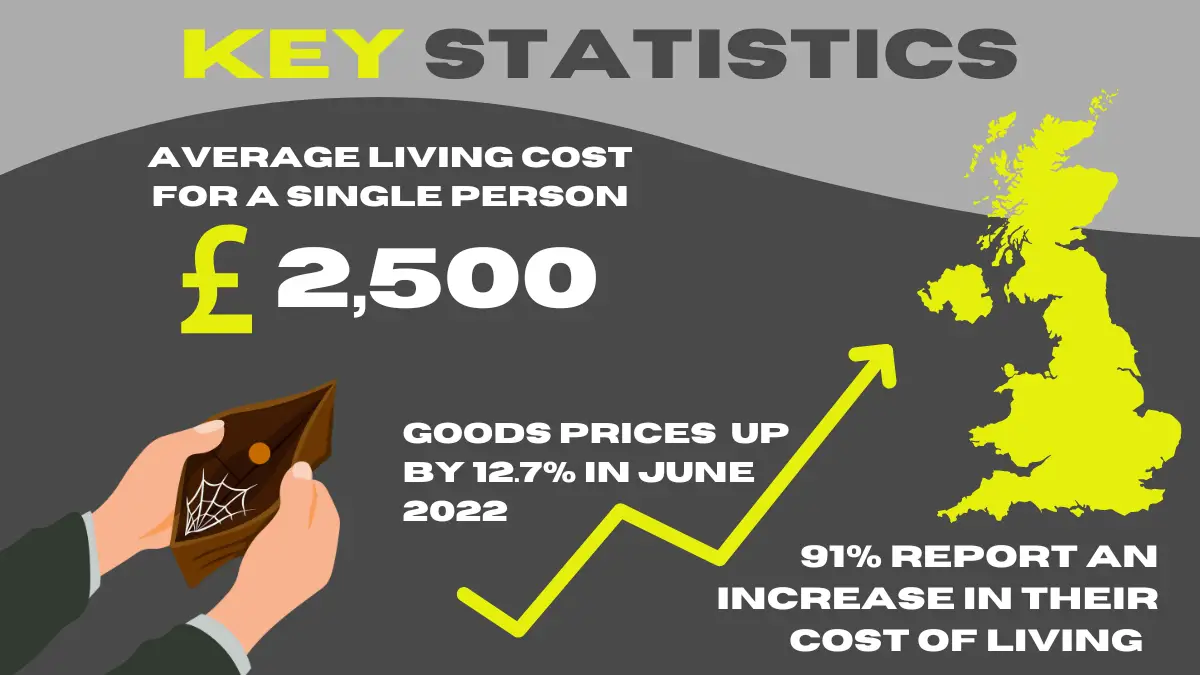

From the war in Ukraine to the changes caused by Brexit, rapid inflation and spiralling costs for essential elements of daily life are creating an environment that is increasingly more difficult to live within. In fact, according to numbers measured by the Consumer Prices Index (CPI), consumer prices were 9.4% higher in June 2022 than a year before.

For young people, the cost of living statistics is important to be aware of. When you’re at a younger age, you’re more likely to make serious decisions that can impact you for years to come. Whether it’s choosing to study in higher education, deciding to move to a new city or making a financial commitment such as a pet or a car.

Whilst we don’t want people to hold themselves back from progressing through their lives, the cost of living increase in 2022 is becoming impossible to ignore. But, being informed will help to guide you in other decisions that can impact you later down the line.

From clothes to food, energy bills and more, it’s more expensive to run a household than just a few years ago and this will affect the future of young adults. We want to give you the tool you need to navigate these worrying times, so we’ve broken down the following:

Inflation has affected prices across the board, and with McDonald’s even increasing the price of one of their cheapest items for the first time in 14 years, it’s clear that nothing can escape inflation’s grasp.

But things are a lot more serious than the cost of a cheeseburger, as the Office of National Statistics found that 91% of adults in Great Britain reported an increase in their cost of living between June and July 2022.

Other key inflation statistics include:

But whilst the cost of living increase in 2022 has financially hit a wide variety of people, it’s the breakdown of the essential elements of life that really reveal just how harsh the impact the cost of living is having.

Utility bills are some of the most inflation-affected parts of our lives that we have to contend with, as energy prices are costing from £66 to £137 a month, depending on the size of the home. Combined with gas prices, households can expect to pay upwards of £220 a month.

However, figures from the Cornwall Insight found that this will most likely increase even further, as the energy price cap will be increasing by another 65% in October, totalling around £3,000.

Other utilities such as TV, phones and WiFi could be subject to an increase, however, there is less of a chance of it becoming unmanageable. If you find you’re facing an increase in your package charge, head over to a comparison website and snag a deal.

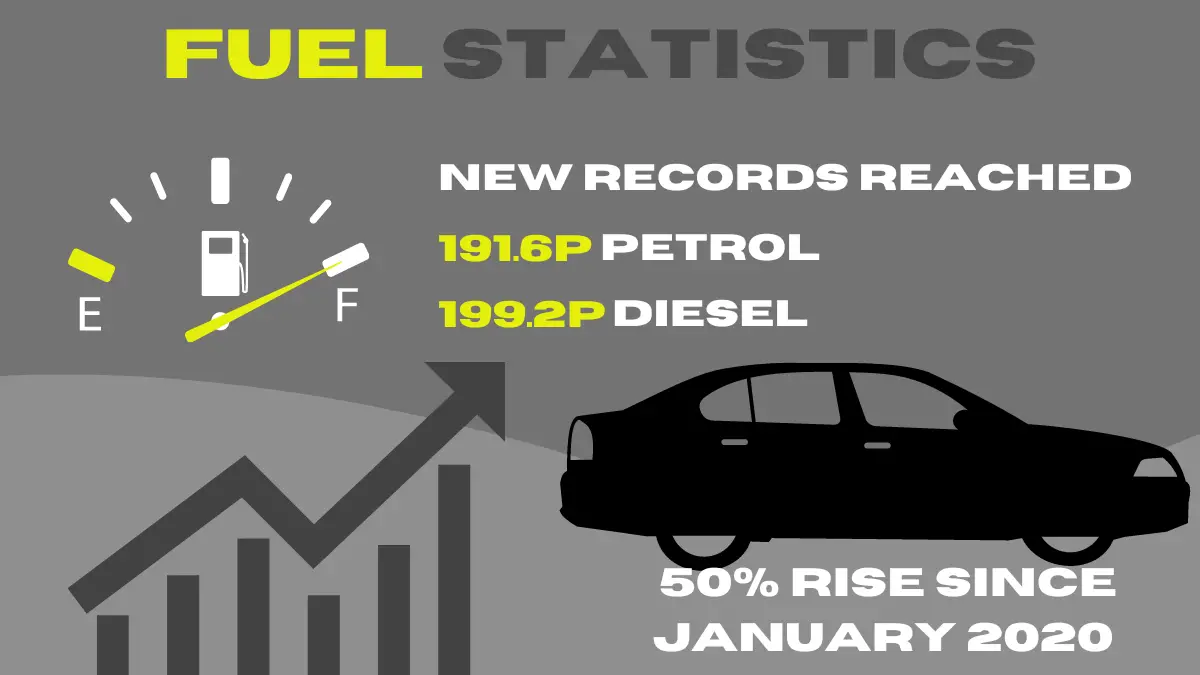

Fuel prices have been a real source of debate for the government and people across the UK, as the prices rise to unaffordable levels with no sign of reducing.

Petrol prices soared from 125p per litre in January 2020, to upwards of 190p per litre in July 2022. This is a drastic change as at the end of May 2020, they were at their lowest level for around five years.

But after years of steady increases and the war in Ukraine leading to Russia raising the price of oil, new records of 191.6p per litre of petrol and 199.2p per litre of diesel were reached on the 4th of July.

These numbers have since begun to decrease, however as tensions rise in the war and inflation continues to send prices soaring, fuel prices are not something to get comfortable with and you should ensure you’re checking over your budget more regularly if you require fuel.

Other utility bills can also be impacted, causing more issues within the home. Adapted homes need maintenance and upgrades for people with disabilities to be able to live full lives. For example, stairlift providers such as Stairlift Trader often need to complete maintenance to ensure the equipment continue operating safely, but this cost can become difficult to manage if you’re low on cash.

But unfortunately, the rise in the cost of living can hurt people’s ability to keep up with these costs. In fact, according to Scope estimates that the extra costs experienced by disabled people amount to £583 a month (according to its 2019 ‘Disability Price Tag’ report).

Energy and fuel price increases haven’t affected households and individuals alone, they’ve also hit businesses who rely on these utilities to provide a service.

As a result, transportation companies have had to raise the prices of their services in order to keep up with the rising costs. Now, in 2022, travellers are seeing commuter costs rising to £387 per month in London, with the average spend in the rest of the UK totalling £66.31 per month.

However, a study found that commuters in East Anglia spend the most on their travel with an average of £78.93.

As an essential part of our lives, food price increases have been one of the most concerning for people who are struggling to find the cash to feed themselves.

Food price inflation has reached new heights in 2022, with ONS recording an inflation increase of 9.8%. This is up from 8.6% in May and the highest rate of increase since April 2009. ONS did note that this has happened due to a number of factors, including rising costs, labour shortages and supply chain issues that have had a ripple effect over the last few years.

So much so that the Institute of Grocery Distribution expects to see the overall annual food price inflation to be around 11% in 2022, with researchers predicting an annual average of £380 for grocery bills.

Food can be difficult to save money on as it is absolutely vital to our lives and not something we can just cut out. We recommend cashing in on any vouchers, discount codes or online deals you spot to save a few extra quid.

The cost of living increase in 2022 will affect everybody and severely hurt people’s bank accounts, no matter who they are.

However, young adults will shoulder a lot of the impact over the next decade or so. However graduates have had their repayment thresholds frozen, so the government will not move the parameters regarding the wage needed to be earned before repaying. Students will also have access to a higher maintenance loan, 2.3% higher for the academic years 2022/23.

But as time goes on and costs continue to soar, workplaces are cutting down on staff to save money on wages and protect their profits. So much so that according to ONS, youth unemployment is at the lowest it’s ever been (10.6%).

This is severely limiting the types of jobs younger people can get, resulting in a distinct lack of activity in their finances. Also, if a young person must claim benefits, they’ll see the value drastically decrease in their payments as inflation continues to rise.

Over time, this will impact their credit score, their ability to move out of the family home and their chances of staying out of debt.

Holly’s Experience Of The Cost of Living Crisis in 2022

We wanted to get a better idea of how this is impacting young people from real life cases. It’s one thing to read the numbers on the page, but the way it translates into day-to-day life can be eye opening.

Holly is a 21 year old graduate living in London, who told us about how the rise in the cost of living is affecting her after she finished her studies.

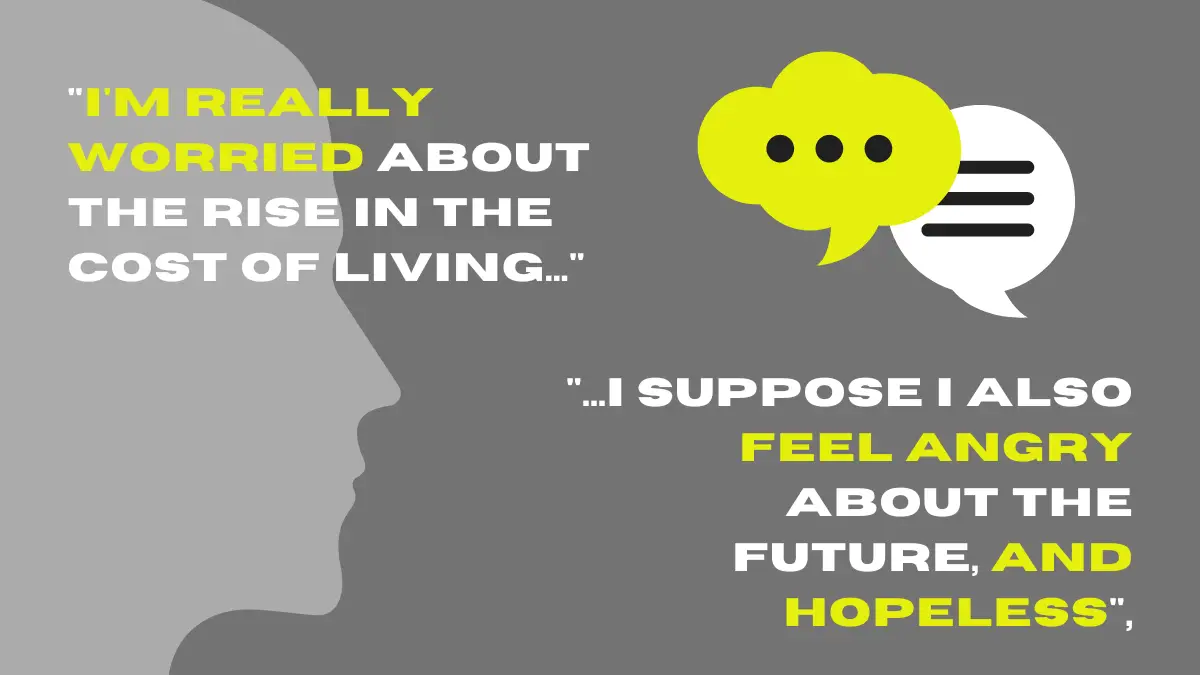

Holly said: “I’m really worried about the rise in the cost of living, as a new graduate who suddenly has a lot more costs to manage. The fact that my weekly shop has tripled in price already has started to worry me a lot.

“In fact, I definitely eat less meat now, because meat is too expensive, and I tend to eat a lot more processed, cheap things. I also now work from home more to save on transport costs, but I don’t actually enjoy working from home, so this is a sacrifice for me.

“The major impacts for me are on the cost of food and goods, as well as transport and social activities. I now have to carefully plan when I can afford to see my friends, and which days I can afford to go into the office.”

Holly’s workplace have tried to support employees with breakfast and snack bars being on offer for people to take advantage of, but that doesn’t solve the problems at home: “I am really worried about the future, as I see the cost of living crisis continuing until a point of civil unrest where people just simply cannot pay for things.

“I would hope that we could tax the super-rich, in order to help fund support, as well as placing regulations on energy companies to stop them from unfairly inflating prices to this level even as they report record-breaking profit.

“I suppose I also feel angry about the future, and hopeless, as this government has shown us again and again that their priorities lie with the top 1%.”

With so much bad news, it’s fair to say we’re all looking forward to the future where we hope things will be better. But how likely is that?

Well, as the government decides on who is to be the next Prime Minister, the future is increasingly uncertain. Some people want to cut taxes, whilst others believe that would worsen the rise in inflation. However, it’s difficult to say that just one decision will resolve people’s struggle, as the ripple effects of the war and Brexit continue to impact the UK.

The Bank of England has stated that they believe inflation will slow down towards the end of the year, and be closer to 2% instead of the current 9% in around two years.

Instead, we recommend taking back control for yourself. By being fully aware of your financial situation, you’ll be able to make decisions that work for you, whilst being aware of what could be hurting your finances the most.

It can be scary to hear all about these concerning figures that seem to spell out doom. But, MoneyBright’s team is here to support you and help you to manage your finances in a less stressful way.

Check out our tips on saving, travelling, personal finance and more, and have a look at our TikTok for some quick and easy ways to navigate your financial situation.