Renting vs Buying: Pros and Cons and How...

In today’s society, deciding whether to rent or buy a property...

Do you only have loose change to pay your biggest bills at the end of every month? Got a money-saving goal that feels miles away?

No one wants to experience the frustration that comes with living pay check to pay check – it’s made worse when saying no to your friends becomes the norm, because you simply don’t have enough in the bank to join in.

Of course, you could always dip into your overdraft or whip out your credit card…

But we’d rather offer you a more sustainable, and less stressful way to enjoy money through budgeting and money-saving.

Save money and be a budgeting pro with us, in less than fifteen minutes.

For some people, the word budgeting can strike fear into their very souls as they begin to imagine restricting their outgoings and living a sad, boring life.

But that’s not the case.

Budgeting is simply keeping track of what’s flowing through your bank account, whilst allocating a fair amount of cash for your outgoings. It is the most effective and straightforward way to avoid running out of money for the things you love the most.

Of course, it can be scary to face your finances, especially if you haven’t had a real look at your bank transactions for a while.

But if you want to feel relaxed about money and confident in your financial decisions, it’s worth overcoming the initial obstacle.

We understand that it can be incredibly overwhelming to face all of this at once, so we’ve taken the stress away from you.

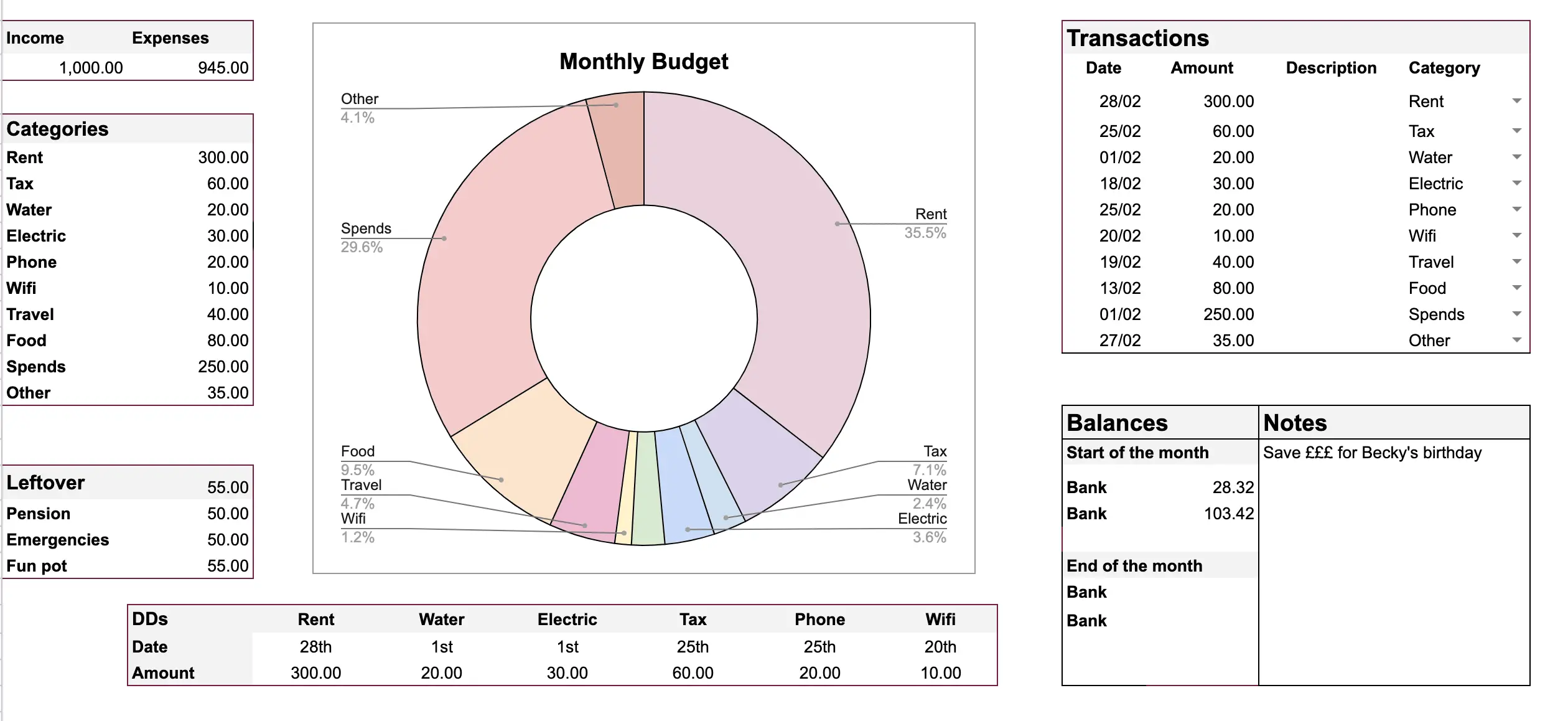

Functions as a way to track what you’re spending, your monthly income and the contents of your bank accounts at the start and end of the month.

There’s even a roundup section, so you can see how much you’re spending in different categories and spot places where you can easily save a few quid.

Don’t panic, it can look a bit overwhelming, to begin with!

We promise it’s actually really simple. Across the budget spreadsheet, each section has its purpose, so follow our explanation and fill it in as we go. You’ll be a money-saving, monthly budgeting pro in no time…

Every section can help you to feel clearer about your finances, but they all work together to give you a clarified overview and a new sense of control.

Sections:

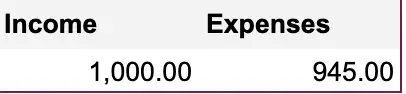

This section is as simple as it gets. You outline your income, and as you complete the rest of the budget template, your expenses will be calculated.

If you just need to quickly check where you’re at in the month or need a fast figure on your total spending so far, this section just does that.

See, we told you it was simple!

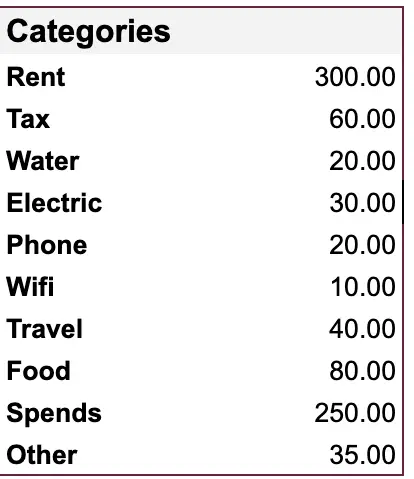

To truly keep track of your personal finances and accurately account for your spending, we’ve created budget categories. These consist of the types of things you’re almost guaranteed to spend your money on each month.

This section is linked to your transactions, so you don’t have to do anything here apart from keeping an eye on those numbers.

(We’ve included the basic categories here, but you can add or remove your own as you please.)

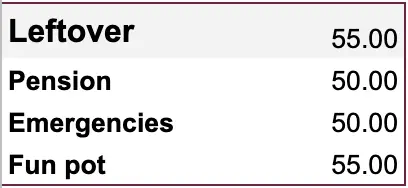

We all love payday, but it can be a bit depressing to see our paycheck succumb to our many outgoings.

To make things easier to digest, there is a leftover section that outlines how much cash you have once your basic categories are looked after.

You can add in any emergency money you have put aside, or any pension contributions. We wanted to make sure this was visible to remind you how important these money pots are, and encourage you to continue adding to them!

Of course, we included a ‘fun money’ element to the leftover section – it’s important to enjoy your cash, so if you’re saving for something in particular that month, pop a figure in here!

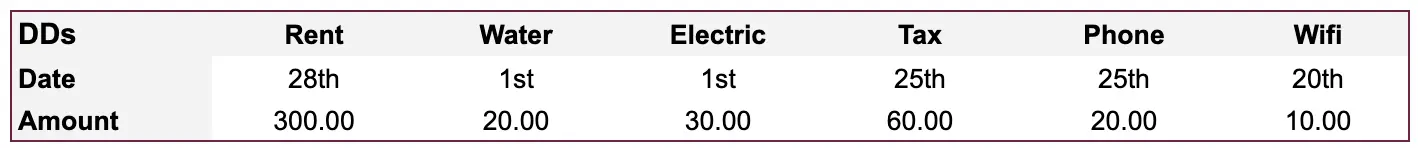

Arguably one of the most important sections – the dreaded direct debits.

It’s so easy to sign up for a free trial and forget about it, only to find it’s been taking £££ out of your account for months! Sometimes our direct debits are a source of shame, so we avoid thinking about them altogether.

But there comes a time when you have to ask yourself, is that £25pm gym membership worth a 20-minute visit once every fortnight?

In this section, we’ve clearly laid out every direct debit, its date and the amount it costs.

By adapting this to work for you, you immediately have a summary of your DDs which will come in handy if you fancy adding another to the list or you need to cut back.

Instead of scouring through your bank statements, they’re clearly laid out for you, so you can make a better decision, with less stress.

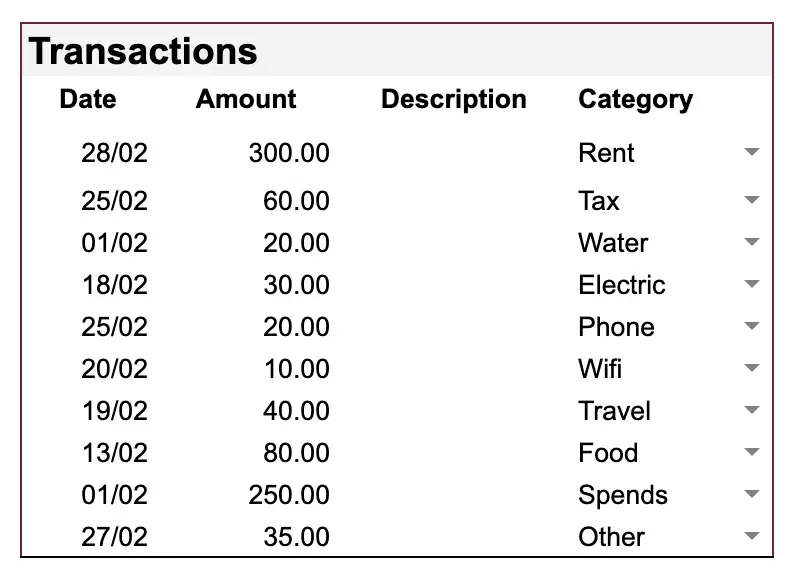

You’ll spend the most amount of time on this section.

We’ve done the hard work and created formulas that correspond with the categories section, along with an easy-to-use drop-down menu to label the expense.

All you have to do is input the amount of money you spent on the category and watch as the sheet updates itself. Add in a date and a description of the cost and you’re good to go!

It’s super simple, but incredibly effective when it comes to keeping track of the amount you’re spending. But be honest with yourself – leaving out costs you don’t want to admit to, or rounding down instead of up, will only leave you in the red for longer.

For many, budgeting and saving money go hand in hand. Once you finally see where every penny is going, you begin to spot places where you’d rather be spending less, and places where you’d like to be spending more.

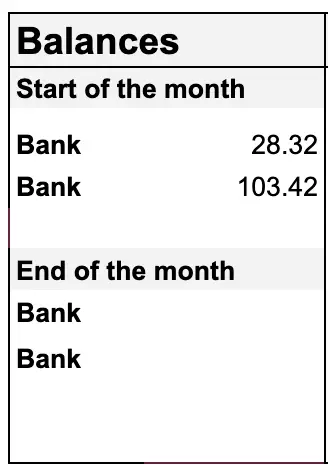

By taking note of your bank balance at the beginning of the month, and making space to include your end balance, it can be even more motivation to save those extra pounds and see the final figure be further into the green than usual.

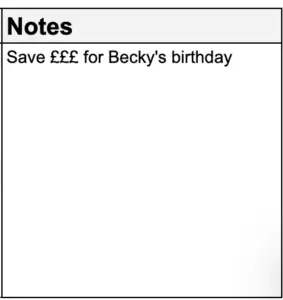

What’s a budget without a place to pop a few notes here and there?

Don’t let those money traps creep up on you and leave you short-changed for the rest of the month. Instead, use this section to add in anything you need to remember, from dates to one-off bills.

You’re done!

See, it wasn’t too bad, was it?

It can be a bit overwhelming to face your money issues and personal finances head-on, so grab a brew and congratulate yourself on completing your monthly budget template.

Of course, that’s not where the hard work ends. Consistently updating it with new information and including accurate transactions will give you an idea of what your regular finances will look like.

Take it in steps! It can become overwhelming quickly, so outline the basics first. Establish your incomes, and your basic payments and build from there. If you try to tackle too much at once, you can overload yourself and be put off from completing the task.